At CoCreate we are always looking to develop strategic relationships that will provide additional benefits to our clients. We are pleased to share that we have onboarded Realized Financial as a sub-advisor to provide private real estate portfolios to fill a very specific need for many of our clients.

Real Estate is a phenomenal wealth builder and it has been particularly powerful in the Bozeman community where we have seen dramatic appreciation of real estate values for many years, well over the national averages. We serve many families and individuals who have acquired a handful of rental properties over the years, utilizing conventional financing and steady rental income to build their asset base, often doing the work of managing and maintaining properties themselves, which further increases their return. If this has been your story, you should be proud of the wise decisions you have made and the hard work you have invested as well as grateful for the favorable market conditions you have experienced to this point.

There are two primary components that often drive a shift out of real estate around the time of retirement. The first is the desire to eliminate the need to actively manage the rental and the second is the need for greater liquidity/lower risk. Maintaining and managing your rental property may not have seemed like a very big deal when you were grounded by your job and motivated to squeeze every penny of profit out of your investment, however, it quickly loses its appeal the first time you have to deal with a busted dishwasher while on your long-awaited international vacation. We often recommend transitioning the property to professional management at this point, which is a great option, often less appealing to the client.

We also frequently encounter situations where the vast majority of a client’s assets are held in real estate. While such a structure may have provided excellent growth during the accumulation stage of life, clients may lack the liquidity needed for their objectives as they move into retirement. People often assume that real estate is an ideal investment in retirement because it provides steady monthly income, however, most retirees also have at least a couple big-ticket items on their list such as remodeling the house or moving, buying a camper, a major trip with the family, charitable donations or even starting a passion business. People who are heavy on real estate often have the asset base that can easily support such objectives, but since the assets are illiquid, their goals are out of reach or much more difficult to achieve. Additionally, when a client is overly-reliant on a rental income stream in retirement without appropriate liquid reserves, they are potentially in a high-risk situation in the event their rental income is disrupted or the property requires expensive repairs or maintenance.

Previously, the only option when determining to sell a piece of investment real estate was to pay a very large tax bill on the gain in the year of the sale. Considering that many of these properties have been held for 10 to 20 years, the combination of significant gains and years of depreciation create a sizeable taxable gain. Now, we believe that it is important to never let the tax tail wag the investment dog and that we should recognize with gratitude that paying taxes is symptomatic of making money, however, we always want to be as tax efficient as possible.

A long-standing strategy to delay the taxation on real estate sales has been the utilization of the 1031 like-kind exchange. These provisions in the tax code allow the “exchange” of one real estate investment property for another. In the exchange, the tax basis is carried over from the old property to the new property and no taxes are due at the time of the transaction as long as the new property is an equal or greater value than the old property so that all the proceeds went into the new property. This is a fantastic strategy when the goal is to build a real estate portfolio or move your assets to a property that is a better fit for your situation, though it does nothing to achieve the concerns of freedom from management responsibilities and greater liquidity.

A requirement for a 1031 exchange is that both the investment properties must be real estate; business interests, stocks, bonds or any other type of investment do not qualify.

We have partnered with Realized in order to offer a solution to our clients who are looking to make adjustments to their real estate investments. Realized can help investors who want to purchase Delaware Statutory Trust (DST) interests for 1031 Exchange transactions. With access to 42 Sponsors, Realized Financial enables investors to tap into a scale and sophistication that may have been formerly unavailable to them. Below are some of the key benefits that make DSTs popular 1031 Exchange solutions:

Professionally Managed: A DST is a passive investment in real estate. The purchase, financing, management, and eventual sale of the property is the responsibility of the DST Sponsor, which allows the investor to enjoy the potential benefits of owning property without the hassle of day-to-day management.

Access to High-Quality Real Estate: The commercial real estate market may be a challenge to navigate for individual investors. Partnering with a respected Sponsor with local market knowledge that has access to professionally managed properties coupled with expertise in management and financing helps investors expand their options when looking for replacement property.

Diversification: Diversification seeks to help manage risk in an investment portfolio. DST investments sometimes offer multiple property portfolios across a variety of property types, as well as broad geographic locations, providing investors with numerous diversification options. DSTs usually have flexible minimum investment amounts, enabling investors to exchange into multiple offerings.

Relief From Underperforming Real Estate: After factoring in the true costs of real estate ownership, many investors find they own property that provides little or no income but are hesitant to sell and pay capital gains tax along with paying depreciation recapture tax. A 1031 Exchange using a DST may provide a solution to seek steady income while potentially deferring a taxable event.

Estate Planning Flexibility: Some investors prefer a role as an active real estate owner while their heirs may wish to be passive owners. A DST can be a powerful estate planning tool since DST interests can be divided among beneficiaries leaving each to decide what to do with their own portion, and the basis on the property steps up to fair market value upon the original owner’s death.

Structure Liquidity over Time: While DST investments themselves are illiquid, they can be utilized to generate liquidity over time instead of liquidating and realizing the entire gain of a real estate investment all in one year. Direct real estate ownership is a fantastic investment for many of our clients, but if you feel that your real estate is no longer serving you in an optimal fashion we would be happy to explore the options with you.

Please be advised that 1031 exchange an other transactions are highly complex and require a team of professionals to properly plan for and coordinate the transaction including the client's tax professionals, real estate professionals, and a qualified intermediary. The actively managed real estate investments provided by CoCreate Financial though its engagement with Realized Financial LLC as a sub advisor may not be suitable for all investors and are only available to those who meet the definition of an "Accredited Investor" and may not be immediately liquidated.

As the year comes to a close, many of us find ourselves reflecting on how we can make a meaningful impact — not just in our own lives, but in the lives of others. It’s important that we understand the options we have available to us to help us create an impact on the things we truly care about.

Charitable giving offers a unique opportunity to align your resources with your personal values, creating a legacy of generosity that resonates far beyond the holiday season. While year-end giving is often associated with tax benefits, the true reward lies in its ability to shape our hearts so that we begin to care about the things we value and believe in.

A mindful approach to charitable giving can be a powerful way to maximize your impact while creating efficiency in your financial plan. Donating appreciated stocks or property allows you to avoid capital gains taxes and support meaningful causes, while qualified charitable distributions (QCDs) offer retirees a tax-efficient way to give directly from their IRAs. Thoughtful strategies like these can help ensure that your generosity creates lasting value, both for the causes you support and for your own financial goals.

Year-end giving isn’t just about the dollars donated — it’s about leaving a meaningful mark on the communities and missions that matter to you most. Let’s talk about how you can make this season one of purpose and impact.

Charitable giving is more than a transaction to give yourself a tax break — it’s a reflection of your values and priorities. Whether you’re supporting local community programs, contributing to global initiatives, or funding a cause close to your heart, giving allows you to make a tangible difference in the world and fulfill your calling to care for others.

At its core, charitable giving is deeply personal. It’s about aligning your resources with your beliefs and making an impact that resonates with your sense of purpose. For many of us, having this alignment can foster a sense of fulfillment and connection, making generosity a source of joy.

Beyond the emotional rewards, charitable giving offers significant financial advantages when used strategically. For donors who itemize deductions, contributions to qualifying charities above the standard deduction can reduce taxable income, easing the overall tax burden. Strategies like donating appreciated stocks or making qualified charitable distributions (QCDs) can amplify these benefits, helping you achieve more with the resources you already have.

While the financial perks are valuable, they shouldn’t overshadow the importance of meaningful giving. The most impactful contributions come from the heart, driven by a desire to create change rather than simply reduce taxes. Balancing financial strategy and emotional intent helps to ensure that your giving is both purposeful and impactful.

By incorporating charitable giving in your overall financial plan, you can make a difference in ways that resonate with your values and bring lasting rewards to both you and the causes you support.

When we think of charitable giving, cash donations are often the first thing that comes to mind. While giving cash is a simple and effective way to support causes, it may not always be the most efficient option. By leveraging the right giving strategies, you can deepen your impact and reap the financial advantages.

These approaches not only make the most of your generosity but also work in tandem with your overarching financial goals.

One of the most tax-efficient ways to give is by donating appreciated assets, like stocks or real estate. When you donate assets that have increased in value since you purchased them, you avoid paying capital gains tax on the appreciation.

On top of this, if you itemize deductions, you can claim the asset’s full fair market value as a charitable contribution. This makes it much more efficient than giving cash and is almost like receiving a double tax deduction.

For example, say you purchased stocks for $5,000, and they have become worth $50,000. You want to make a donation of $50,000 to your favorite charity, so you decide to donate the shares of stock. By donating the shares of stock, you get to deduct the full $50,000, instead of owing capital gains tax on the $45,000 profit. The charity will then get to sell the stock with no tax.

Donating stocks that have grown significantly in value allows you to support your valued causes without reducing your portfolio or donation’s overall value because of the tax implications of selling the investment. This method is particularly effective for those with diversified portfolios who want to rebalance their investments while giving back.

Examples of assets you can donate include Stocks, Bonds, ETFs, Real Estate (full properties and fractional interests), business interests, mineral rights, and even crypto-currencies.

You can donate stocks by providing your financial advisor with the organization’s account number and the DTC number of their investment firm. Be sure to let them know to expect your donation so they can provide you with the appropriate gift receipts. For other types of assets, reach out to the charity ahead of time to discuss your gift to make sure they can accept the gift.

If you’re 70 ½ or older, qualified charitable distributions (QCDs) can be a great way to give directly from an IRA or an Inherited IRA. A QCD allows you to transfer funds from your IRA to a qualifying charity, satisfying your required minimum distribution (RMD) without adding to your taxable income. Since QCDs do not hit your income, you essentially receive the benefit of a charitable deduction even if you do not itemize and the donation does not count for income for purposes of determining your medicare premiums.

This approach is especially useful for retirees who want to support charities while managing their tax obligations. By using QCDs, you can reduce your taxable income and help your chosen organization, all while fulfilling your RMD requirements.

Donor-advised funds (DAFs) can also provide flexibility for those looking to make a long-term charitable impact. DAFs allow you to contribute assets, receive an immediate tax deduction, and distribute funds to charities over time. This strategy may be worth exploring with your trusted financial advisor if you’re looking for a structured approach to giving.

There are many advantages to donating to a Donor Advised Fund here are just a few of them:

Charitable giving often comes with questions about financial security and whether you can afford to give without jeopardizing your long-term goals. It’s natural to feel cautious, especially when balancing current needs with your future objectives. However, with thoughtful planning, you can move past these fears and experience the fulfillment that comes from making a meaningful impact.

Many people hesitate to give because they worry about all of the “what if” scenarios — unexpected expenses, market downturns, or changes in income. While these concerns are valid, they often lead to holding onto resources far beyond what’s necessary for your financial security. Working with the right financial advisor can help you identify how much you can safely give, allowing you the clarity and confidence to contribute without compromising your stability.

Charitable giving is not about depleting your resources; it’s about using them intentionally to create positive change in the world. Take a moment to think about the financial flexibility you already have. Are there areas where you’ve saved more than enough? Could reallocating some of those funds toward causes you care about bring greater purpose to your financial plan?

We are all called to use our resources to help others and make a difference in the world. By reframing your surplus as an opportunity to give, rather than something to hoard, you can change your greater approach to managing your assets. Giving becomes less about obligation and more about empowerment.

If you’re worried about whether charitable giving is the right strategy for you, ask yourself:

Charitable giving becomes powerful when it reflects who you are and directs your heart to what you care about most. By making sure that your contributions align with your values and passions, you can create a deeper connection to the causes you support, while ensuring your generosity can have the greatest possible impact.

Everyone’s values are different, and your giving should reflect what resonates most with you. Maybe you’re passionate about supporting education programs, protecting the environment, or empowering traditionally underserved communities. Whatever your priorities, you want to take the time to identify causes and organizations that coincide with your vision for a better world.

Don’t let your connection with a charity begin or end with writing a check. Ongoing involvement in the charity’s work will connect you deeply with the organization, provide important non-financial support and encouragement to the organization, amplify the power of your gift, and inform future giving decisions.

Reach out to the organization directly to learn about its mission, goals, and specific needs to determine if those align with your charitable intent. The development staff for the organization can share impact reports, budget goals, future strategic initiatives, and information about how they would steward your donation.

Consider how you can volunteer on the front end of the organization’s work, in the background, or engage with the organization’s leadership. If you are supporting a local organization, you may even consider serving on the board or assisting in fundraising.

Charitable giving can also be an opportunity to involve your family. Discuss the causes you care about with loved ones and consider making these decisions together. This not only deepens your impact but also fosters meaningful conversations about values, priorities, and legacy, which can be an incredible relationship-building tool.

Even young kids and grandkids can be brought into the giving conversation. Consider asking them where they would like to give, discussing the challenges children in your community and around the world face, and exploring the organizations that provide hope. You may be surprised and encouraged by their youthful thoughts, perspectives, and engagement.

When your financial plan incorporates your charitable goals, it helps ensure your giving remains intentional and sustainable. By working with a CoCreate financial advisor to structure your contributions to align with both your values and your broader financial goals, you can make sure that you are making the most of every single dollar.

Charitable giving isn’t just about the actual act of giving, it’s about doing so in a way that aligns with your unique financial situation. Working closely with your financial planner can help you maximize the impact of your contributions while ensuring they fit seamlessly into your financial plan.

Your charitable contributions should complement your long-term financial goals, not compete with them. By incorporating giving into your financial strategy, you can:

A skilled financial advisor can help you understand your giving capacity and design a strategy that reflects your values while maintaining your confidence in your future.

As December 31 approaches, it’s important to take proactive steps that ensure your charitable giving is both impactful and efficient. Start by discussing your plan with your financial planning team to identify the best opportunities for your strategic giving. Beginning the process early is crucial, especially for non-cash contributions like stock or real estate transfers, which may require additional time to process.

The end of the year is also a great time for setting clear goals for your giving, like deciding which causes or organizations to prioritize and how much to contribute. Just remember to keep thorough documentation, including receipts, appraisals, and transfer records, to remain compliant and optimized for all potential tax benefits.

Even with the best intentions, there are common mistakes that can undermine the impact of your charitable giving if you’re not aware of them.

Waiting until the last minute to execute your giving strategy can lead to rushed decisions, missed opportunities, and logistical challenges. Non-cash contributions, such as donating stocks or property, often require additional time to process, and rushing could result in failing to meet the December 31 deadline for tax benefits. Starting earlier in the year can help you make thoughtful and seamless contributions.

Not all charities qualify for tax-deductible donations, so you must verify that the organizations you support are eligible. By that same token, strategies like qualified charitable distributions (QCDs) come with specific rules, like age and contribution limits. Understanding and adhering to these requirements will help you avoid unintentional errors and make the most of your giving’s financial benefits.

Charitable giving is one of the most meaningful ways you can use your wealth to engage your personal values. By using strategies like donating appreciated assets and leveraging qualified charitable distributions, you can maximize the impact of your contributions while optimizing your financial plan.

As you reflect on your goals and priorities, remember that giving is about making a lasting difference for the causes and communities you care about. Whether you’re supporting local initiatives, global efforts, or personal passions, your generosity can ripple outward to create a lasting change, no matter how small or inconsequential it may seem.

This year, we urge you to take the time to plan your giving intentionally. Work with your trusted financial planners to develop a strategy that aligns with your values and ensures your resources are used effectively to serve your greater purpose.

This article is about the stock market decline on December 18, 2024. It is made up of notes and thoughts on December 19th at about 8:00AM. Stocks opened higher today, but there may be more to come.

Yesterday, the “markets” declined rather precipitously, with the S&P 500 ending down 2.97%. Of course, nobody actually owns the index itself, so everyone’s experience was a little bit different. If you’ve taken a business-minded approach, you probably faired significantly better. Fortunately, our portfolios have naturally avoided many of the investments that have become overinflated and crashed multiple times this year. When these market events happen, however, they tend to impact everything for the short term. Yesterday was what we call a a 90% downside day, the first since August 5th (>90% of NYSE operating stocks declined and at least 90% of the volume and points traded were in declining stocks). There are actually a number of these each year, and they aren’t cause for alarm unless you’re a short-term trader or haven’t adequately planned for your immediate cash needs. In fact, we generally have several corrections each year (1-2 that drop about 5% and 1 that drops about 10%).

Over the past couple of weeks, we’ve been experiencing a relatively quiet version of one of these corrections. Most companies have been consistently declining for about 10 days, but they have been buoyed by the excitement about AI stocks. Because the S&P 500 and other cap-weighted indices are so heavily concentrated on the biggest companies they don’t always reflect what is happening broadly. Yesterday’s action brings us into the territory of a meaningful correction of the 10% variety. It is possible it could accelerate, but 90% downside days tend to happen a the beginning or end of these corrections and we think this one is already a little bit extended. Moreover, the events that seem to have led to yesterday’s drop were neither surprising nor particularly significant. We’ll discuss a few key issues that are relevant to what’s happening in the markets. Keep in mind that the best thing to do is often the hardest: be patient and disciplined. If we manage your investments, we’ve designed them specifically to perform well in difficult conditions, and you own businesses we believe are extremely resilient and meet our rigorous financial requirements.

“Oops I did it again, I played with your heart, Got lost in the game…”

Oh Baby, Baby, who knew back in the 1990s that Brittany Spears was actually singing about Jerome Powell and the federal reserve.

The Federal Reserve announced yesterday that they were proceeding as planned with a .25% interest rate cut. They also left their official statement unchanged from their previous press conference, in which they explained that they would take a more thoughtful approach to future rate cuts. When Powell was asked to clarify that statement, he indicated that it meant that rate cuts would slow down in the new year. There are a few really key considerations here:

Overall, the Federal Reserves less dovish stance should be a good sign for the markets in the weeks ahead.

Can we all agree that the threat of a government shutdown is now a holiday tradition? If it is, I’ll take it. It would be great if the Government was good at using its resources to make our country better, but when it can’t seem to balance a budget, keep its spending within a healthy proportion to GDP (less than about 19%), and our politicians’ main goal with the budget process is to implement non-budgetary legislation and increase their own salaries, it doesn’t feel like a budget should just be forced through.

Interestingly enough, the reduction in government spending that comes from a shutdown (if it does happen), is actually a good thing for the economy. This is especially true when our money supply is still out of control and inflation is still a problem. We can take solace knowing that the markets haven’t crashed because of a shutdown (going back as far as the year 2000).

The threat of a government shutdown may sound scary, but in reality, the Government isn’t a producer in the economy. They don’t sell a product, invent things, or make money providing services. The money they spend MUST come from productive segments of the American economy (taxing its citizens who profit from business activity). If this is out of balance its extremely harmful for economic growth. A temporary shutdown of non-essential government services, is actually helpful rather than harmful. IF the end result is a better compromise and can ultimately reduce spending and other negative partisan activity, then it can be very good.

On December 13th, Microsoft made a statement that it doesn’t need more chips for its AI projects. Nvidia dropped a significant amount on the news (it is speculated that Microsoft is 13% of their sales). Other AI Stocks spiked and subsequently retreated, but the effect of Nvidia’s drop was felt more broadly because its exorbitant return, along with other AI stocks have played such a significant role in the S&P 500’s positive growth this year. When AI prices drop, the index funds drop in price as well (especially when there are other sectors correcting)… when people sell the index fund because its price is declining, it causes further decline in AI and every other company in the index. That means that everyone’s stocks decline a little bit in their prices.

This isn’t a surprise if you’ve been thinking about the sequence of how AI needs to be implemented. It did need a groundswell in chip manufacturing at the beginning, but that levels off, both as the major data processing centers become equipped with their basic needs and as the focus shifts to other supply challenges. Microsoft identified power in their specific comments about chip needs. The bottleneck has moved to something else. What’s more is that the AI craze is not because AI is a brand new invention, but because it is much more widely available to the public. Business services have used AI for years, so many of the major consumers of AI were already spending resources to use it before Chat GPT. We have been skeptical of the long-term legs to the craze for these reasons. AI will certainly have major implications on the economy and stock market, but these will take a few more years to play out. Nvidia’s value should have increased significantly because of their coincidental ability to be ahead of the spike in demand, but nowhere near as much as it did.

What does this mean for non-AI stocks? It means that we will see a redistribution of capital from companies like Nvidia to other sectors of the market. Some will reallocate to invest in power, others to financials, foods, or wherever they see the opportunity to invest and make money. Sector rotation and balance is very healthy for the market and is a natural part of the business cycle. For those not invested heavily in AI, this is a tailwind.

All of that sounds very optimistic. We have a lot of economic challenge ahead of us in the coming years. national debt is still through the roof, we are still struggling with shortages in the workforce and personal savings is down while consumer debt has risen significantly. Except for consumer financial health, these are long-term problems that our leadership will need to make difficult decisions to solve. Whatever is left, will be up to the creativity of businesses to fix. These are not issues that show up as short-term market fluctuations like we saw yesterday, but in slower economic growth.

We have been watching these headwinds for quite some time and have positioned our portfolios in investments that we believe will perform well in these conditions for the long-term. If you have questions about your investment, please feel free to contact us anytime.

Here are two sets of charts that we feel do a great job of explaining what is happening in the stock markets over the past few weeks. The first is one that we created about a month ago that illustrates the tech bubble on July 10th. The second chart shows three different stock market averages, the Nasdaq 100 (about 60% technology), the S&P 500 (about 40% technology and heavily weighted in just a few companies), and the S&P 500 equal weight index, which gives an equal representation to each of the 500 largest companies in America. These three charts illustrate the tech bubble burst We believe the S&P 500 is a terrible representation of the overall stock market and when it is used in a portfolio as an investment (in a fund), it's actually a high-risk "momentum" investment. Because the Nasdaq 100 is even more heavily concentrated in Big Tech companies than the S&P 500 index, when we look at the two side by side it illustrates the impact the technology sector has on what most people call the stock market (the S&P 500).

People have been overly excited about the impact that publicly available AI will have on the economy and on profit margins. In short, the tech bubble is bursting, but the broad market is much healthier. The business-minded investor has a broader and longer view of the market, and resists the temptation to speculate. When you look at the S&P 500 Equal Weight, which is very closely aligned to the performance of our portfolios so far this year, you see a much different picture. For people in diversified portfolios (not an S&P 500 ETF) who are thoughtfully evaluating profit margins, business models, and dividend payouts, the story has been much more positive (blue line in second chart).

We've been skeptical of the Big Tech explosion for some time, and even made some adjustments in our client portfolios in July to account for the increased risks of the tech bubble. We believe that there will be some upside from here, but we aren't out of the woods yet. The election is coming soon and markets should be quite turbulent until then. In the mean-time, dividend-oriented businesses that fit or investment criteria are generally in a strong position and are continuing to increase dividends despite inflationary pressures and other economic challenges. These should be the strongest companies in a recovery, and have mitigated losses very well in the past weeks. We are excited to continue to collect cash from dividends to be reinvested ate better pricing.

All in all, we aren't particularly concerned for the long-term investor who is in an appropriately managed investment portfolio. It may even prove to be an exciting time with great entry-points for new cash.

A contact directory for our clients.

Matt Hudak, AAMS®, CFP®

We don’t publicly engage in much discourse that touches the political spectrum. We believe the polarization of American society is the greatest geopolitical and economic risk we face today and in order to overcome this risk we need to come together. In turn, we do our best to put our energy into listening to a diverse range of ideas and opinions. Most of our personal ideology is centered around loving people who are different than us and coming together. At times, it can be difficult to publish about important economic topics and concepts without crossing lines into politics and divisive rhetoric. Nevertheless, we will attempt to take a neutral political perspective while addressing the challenges to the strength of our economy.

There are several key concepts we feel should be relatively apolitical and have benefits for both sides of the spectrum. These concepts are primarily monetary & economic—politics-adjacent, but overshadowed by divisive rhetoric and ineffective dialogue. Before we can engage any productive solution, of course, our political leaders must learn to work together. This collaboration seems nearly impossible, but it begins with each of us.

While a lot of the headline economic reports look good, and the 7 companies that represent the “stock market” have shot up (a little sarcasm for you. Microsoft, Apple, Amazon, Meta, and Alphabet represent 31% of the S&P 500, what people mistakenly call the “stock market”). The reality of our economic environment is a little more complicated. We believe that we are currently in a ghost recession. Primarily because savings are low, people are feeling the pressure of higher costs and are thinking about how they use their money carefully. When we see positive data points, there are often divergent stories in the components it represents.

Before we suggest a few helpful ideas, we should identify the drivers behind the challenges facing our economy.

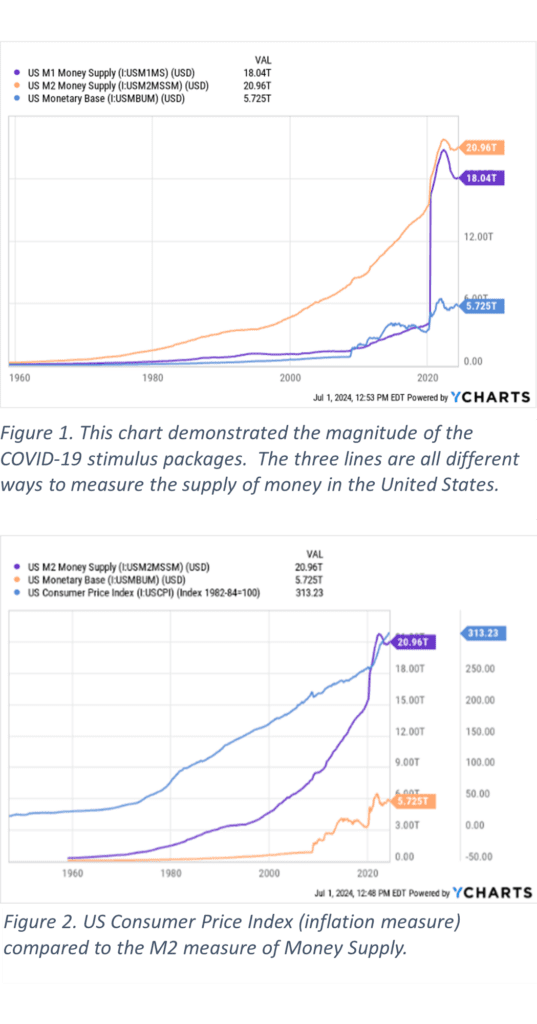

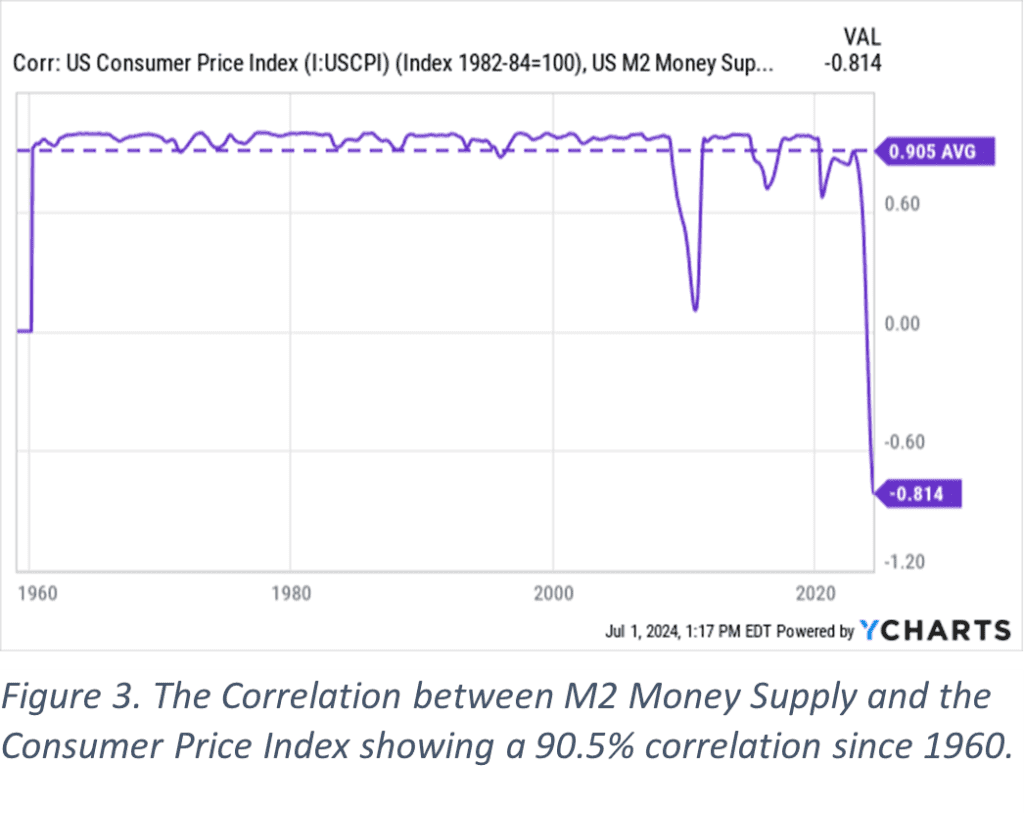

M2. If you’re an economics nerd, that’s all I should need to say. Most economists and officials are too busy trying to figure out how to turn on their flashlight to realize it’s high noon on a sunny day. Contrary to what you may perceive from the world’s obsession with central banks, inflation doesn’t have anything to do with interest rates. Interest rates can affect the speed of inflation, spreading it out over a slightly longer period of time, but no change in interest rate policy by the federal reserve can ultimately change the purchasing power of a dollar. What’s astonishing is that the obvious realities about the monetary system haven’t really been a part of the conversation at the policy level. Perhaps its because both parties are equally responsible for directly causing the current inflationary environment by more than tripling our money supply (M1) in less than 12 months. The M2 measure increased by 40% in the same timeframe (We think M2 will prove to be the predictor of inflation. To wit, prices and incomes will eventually reestablish balance with M2).

It shouldn’t go unnoticed that the M2 measure of money supply and inflation have a near perfect correlation and as seen in the chart in figure 3, until November of 2023, had never before been inverse. They move together 90.5% of the time. In fact, all of the anomalies shown in the chart are at point of major government intervention in the monetary system, and they are all followed by a rapid reversion to the normal correlation. We believe we will see the same effect in the present.

Simply put, inflation is the effect of supply and demand for the dollar. Just like the price of a carton of eggs or a used car changes depending on whether they are hard to find on a shelf or if the dealer can’t seem to move them off the lot, the dollar has more or less purchasing power if there is an abundant supply or if is scarcer in relation to goods and consumers. Policies that are effective at combating the inflationary riptide of a surging money supply will either claw back such supply, limit its future growth or distribute it among a higher number of productive citizens.

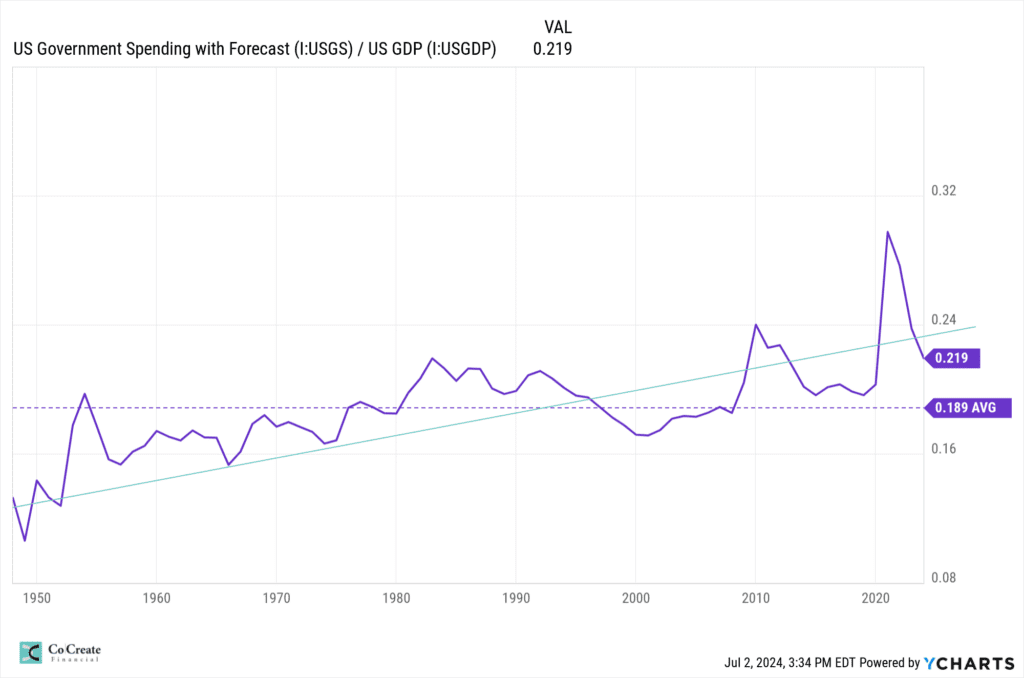

Government spending as a percentage of GDP isn’t as much through the roof as it might seem when we compare it to historical norms, but it's too high for a healthy and growing economy. This is especially true with the current level of debt. Republicans and Democrats alike stand on platforms to expand spending. Regardless of what each of us deems worthy of government funding, those funds need to be in balance with the overall productivity of our country. GDP is the total value of goods and services the US produces (consumer spending, government spending, investment, and net exports). If we imagine a scenario in which Government spending accounted for 100% of GDP, where would they get their revenue? In this hyperbole, there are no businesses or personal revenues to tax (taxable revenues begin with business investment and consumers spending on their product)

The key in a realistic solution is in finding a balance between government spending and non-government productivity. I would suggest that a healthy level of government spending (in the system we have in place today) should not exceed the 18% average (since 1947), but is probably better averaging 14%-15%. If it exceeds that rate, any additional revenue it needs has to come from non-tax policy that stimulates productivity growth in the non-government components of GDP.

This is not a “border wall conversation,” and it is a particularly difficult conversation to have given the contention surrounding the topic of illegal immigration.

The process for allowing a person who lawfully applies to leave their country to enter the United States, is painfully slow—bureaucracy for the bureaucracy’s sake. It would be easy to expedite this process for productive, low-risk people who want to come to the US to work, pay taxes and spend money. The median processing time of an application for an immediate family member of a US citizen is 11.3 months and an application for an alien entrepreneur (I-526) is 53 months. A green card takes 13.6 months. Half these applications take longer and are probably just sitting on a desk.[1]

Immigration is inherently disinflationary. When we discuss inflation in functional terms, it really must be done hand in hand with population growth. Inflation and disinflation are the impact of supply imbalance between the dollars available in the system and the goods & services available. The goods and services are, at least in our present circumstances, relatively static (except, of course, when supply chains are temporarily disrupted). Because those are static, more money means higher prices. They are directly correlated as we discussed above. Adding more people into the equation, however, dilutes the money supply. Ultimately as the end consumer, we choose where we direct the funds we possess. If I don’t have as many dollars, I am more careful about how I spend them. I’m also more inclined to be more productive so that I can earn more.

GDP growth in the US is negatively impacted by a less productive population. This is both due to an aging population (i.e. retiring baby boomers and increasing life expectancy) and an economy that is highly developed. Immigrants have proven to be highly productive and innovative because they are motivated by the opportunities of their new situation. Immigrants also tend to be younger and have larger families than those born in the US. By expediting the application process for entry into the United States, we can effectively boost GDP Growth while curbing inflation.

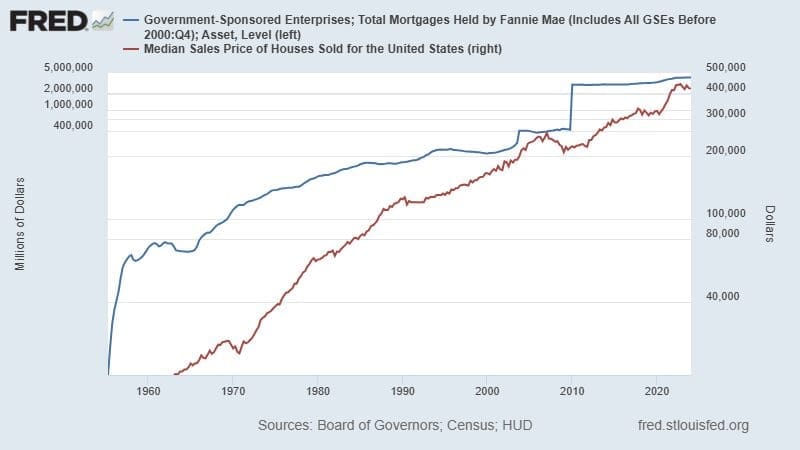

Imagine you’re selling your home and you have two buyers. Both of the buyers can afford to pay $7,000 toward their monthly mortgage payment and have saved $40,000 for a down payment. The first buyer has a bank that will lend 80% of the purchase price. That means they can afford to make an offer for up to $200,000 ($40k/[100%-80%]). The second buyer is working with a bank that has an investor who can take a higher level of risk and so they are willing to finance up to 95% of the purchase price. This second buyer can afford to make an offer for up to $800,000 ($40k/[100%-5%]). Sellers naturally sell to the highest bidder. Assuming there is enough demand, the maximum price is limited to the amount of capital available to the consumer. If you’re considering your options, and everyone is buyer 1, then your sale price can only be $200,000. If your market has buyer number 2, you’ll naturally try to sell to them for $800,000… just because you can.

This is exactly the scenario that led to the 2008 housing crisis. Before the Government Sponsored Enterprises (Fannie Mae, Freddie Mac, et al) began packaging loans and reselling them (CMOs) in the early 90s, the banks lent money from their own portfolios. This meant that they had to be more careful because they were responsible for the loan until it was completely paid off. Banks typically required 20% down because it meant that their borrower had demonstrated capacity to make payments and manage their funds for an extended period of time. Now, this may seem exclusionary to many, but changing this percentage doesn’t change how much a person can/needs to put down.

When CMOs came along, the banks no longer needed to lend from their own portfolios but could be paid to originate the loan and sell it to a third-party investor through the Government (not technically, but the GSEs are essentially the government). There was so much demand from the GSEs to buy the loan that banks could hardly justify making loans the old way, and so the GSEs gained control over the markets. To increase homeownership levels, they began lowering down payment requirements all the way down to 3% and a borrower could use up to 45% of their income to purchase. Now, if you’re the lender, and you don’t offer the 3% down option when all the other banks do, you simply lose the revenue from making the loan. Banks, who had figured out how to structure loans that were safe for both lender and consumer, could no longer compete if they didn’t conform to the GSE’s structures. This created buyer number two (along with all the other ethical problems of consumer fraud and predatory lending). Remember, you’ll sell for the highest price just because you can. Buyer number 2 had 4 times as much capital, so the home price quadruples to match the money supply.

There have been several points in history when the Government has infused a substantial amount of capital into the housing and education markets. The effect has been dramatically increased costs.

Sallie Mae is the GSE for student loans. The same principle applies to student loans as housing. If students have limited funds for their education, the universities will work within those constraints and charge less. When student loans are nearly unlimited universities would be stupid not to maximize their income. In fact, they are forced to increase student costs in order to stay competitive. If a bank were to lend to students from their own portfolio, they would want to make sure the student can pay the loan in the future. The bank would consider the cost of the education program, the income potential for the student upon graduation, and the students commitment to graduating with a degree. All three are major problems that have presented in the current crisis.

These are the fundamental economic roots of the housing affordability crisis and the student loan crisis. We could make significant headway in both areas and dramatically reduce inflation more broadly if we placed significant limits upon the GSEs or dissolved them entirely. Additionally, Student loan forgiveness would be much more palatable if there were a long-term solution to the problem. Sallie Mae could be dismantled and unwound in conjunction with some sort of student loan forgiveness program or benefit for those who have been victims of this Government Sponsored Entity.

Recently the Tax Foundation published a lengthy research report (available here) discussing reform of the non-profit sector, noting that the net income from business-like sources would raise nearly $40 billion in tax revenues. I’ve been very involved in charitable work and was quite perturbed at the idea until giving it full consideration.

Most of the not-for-profit sector are made up of organizations like credit unions, insurance companies, athletic associations (i.e. NCAA), consulting firms, insurance companies, and golf clubs. Most businesses can adopt the form of a non-profit organization, it just means identifying how it serves the public/its members and it can’t pay its profits to owners (it can, however just convert the dividend to “reasonable salary”). What if we narrowed the definition of what a charity is, and the non-profit businesses could pay tax on their net profits just like any other corporation would (excluding income from charitable donations). This would level the playing field for competition and broaden the tax base by approximately 10% of GDP. IF the non-profit business uses its revenues to cover its expenses, those would not be taxed just like businesses deduct their expenses. The Government could use the $40 Billion of excess revenue to help resolve its budget deficit and pay down the insane amount of debt it has amassed in recent years.

People have been discussing the future solvency of the Social Security programs for a long time now. We have our thoughts and positions (essentially that no politician wants to alienate their voter base over an issue that won’t be critical until they have retired themselves), but have a couple of obvious observations. When Social Security was created, the average lifespan of someone taking benefits was around 3 years. It's much longer now, and we need people to retire later. Congress is obviously divided on this issue and whether we should or how we go about forcing it. At the same time, there are policies in place that disincentivize people who want to continue working. Instead of forcing a new retirement age, Congress could begin by simply removing the disincentives for staying employed and push some of their costs back into the private sector (which would in turn create more taxable profits).

The first change to address would be the social security benefit itself. Your Social Security based on your benefit at your FRA (full retirement age). For most people going forward, that is 67. If you take it early, you receive reduced benefits. If you wait to take it until age 70, you receive an 8% annual increase to your benefit over those three years. After you're age 70, there is no reason by which you could justify waiting longer. Why couldn’t we create some mechanism by which someone could continue to benefit from deferring past age 70?

Amplifying the effect, if you continue to work after you start drawing Social Security, after certain thresholds, your benefits are both partially taxable and are reduced relative to your earnings. If your goal is to continue to work into your 70’s or 80’s (more common than you would expect), then your decision causes you to lose much of your social security benefit while still paying into the system for others. The system causes a meaningful imbalance for those that could be reducing the burden on the system. We should simplify the system by increasing the ability to defer indefinitely with some incentive, and remove the benefit penalties for earned income.

The second issue to resolve is to establish a system for individuals to continue without Medicare beyond age 65. If you don’t file form Medicare at 65, you incur substantial penalties when you do file. There are exceptions to this if you properly apply, but these should be the rule of thumb. If you have adequate health coverage by another means, the Medicare program should be glad not to have to pay for your health coverage. With the broad scope of the Medicare program, this shouldn’t impact their ability to underwrite their costs. There is even a possibility it could cause a net reduction in the cost of healthcare across the board. Medicare also has significant premium penalties for those who pass certain income thresholds. If the end goal is to have more employed people contributing, this penalty needs to exclude earned income.

The current tax code allows for a property owner to sell their property in a like kind exchange. For many, they have been able to save for retirement by owning rental properties. While there is a lot of power in the ability to use debt to finance a rental or two, the structure is often less ideal when transitioning into retirement. Income is not truly passive, it isn’t from diversified sources and liquidity is a major obstacle if there aren’t significant savings in other categories. Many who have built their nest egg on a few rental properties feel trapped because of the massive tax burden they can become subject to in a sale (up to 100% of the price could be taxable). The IRS should allow, at least for a time, owners of these properties to defer taxes by depositing the proceeds into an IRA or 401(k). This allowance would allow owners flexibility to position themselves most efficiently, increase the housing supply for entry-level buyers, and would cause a net increase in tax revenue for the IRS over the long term (ordinary income vs capital gains / inherited IRA rules vs step up in basis).

If you don’t have a retirement plan from your employer, it is much harder to save in tax deferred accounts. Your annual contributions to your IRA and Roth are limited to $7,000. IF you have a plan through your workplace, you can defer much more (23000 in a 401(k)). There are other options between and some that allow for even more. It would make sense to increase the limits of each plan to the 401(k) limits creating a fair structure for individuals and small businesses. If many people increase their contributions accordingly, it would slow the pace of inflation by removing those dollars from circulation until the account holder begins their retirement. Coming full circle, the amount of money available directly correlates to the price of goods and services. Creative solutions that remove this capital from the playing field, even temporarily, are more effective than parlor tricks with interest rates.

[1] Historic Processing Times (uscis.gov)

We're really excited to announce our cocreate financial client portal and app. In the first few days of July, each of our clients will receive a link and instructions to set up a new portal account. We've been working very hard to include a lot of useful features and have complete control over how your reports appear. You'll be able to schedule appointments and engage with us right through the app.

We're confident this is a HUGE upgrade and will help us serve you more effectively!

You can download the new app on your app store by searching for CoCreateFinance or clicking here

Our Developers have created an instruction manual for us to provide to you. download it here.

We get a lot of questions about how to teach kids about money, and for good reason! Every parent wants their kids to develop the skills to be successful and live a meaningful and impactful life and we all know that money management plays an important role. When considering engaging your children (or any young person in your life) about money, here are some principles to remember:

Tell us what you have done with your kids to teach them about money! Please take a moment to write us a note (some of our best ideas come from our clients). We would love to share your great ideas with other parents in the CoCreate Community.

Welcome to CoCreate Financial! Embrace the excitement as we unveil our brand new client portal feed. This test blog post aims to enhance your experience and keep you informed about the latest developments. At CoCreate Financial, we believe in fostering a co-creative mindset, where our team collaborates with you to achieve your financial goals. With our personalized approach and expert insights, we offer a wide range of products and services designed to empower your financial journey. Schedule an appointment online or give us a call at (406) 206-7571 to embark on this transformative experience. Visit our office at 1805 W Dickerson St, Building 2, Suite 3, Bozeman, MT 59715, and for any correspondence, kindly mail to PO Box 4785, Bozeman, MT 59772. We prioritize transparency and are registered as an Investment Adviser in the state of Montana. While we provide factual and up-to-date information, please consult with a professional adviser before making any investment decisions. We strive to empower you with the necessary knowledge, and for your convenience, we provide hyperlinks on our website. However, we do not endorse any third-party websites. Our services are specifically tailored for U.S. residents. Remember, past performance may not predict future results, and all investments carry risks. Rest assured, our dedicated team is committed to working with you in creating a profitable and secure investment portfolio. Thank you for choosing CoCreate Financial!

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]Thinking about the future of your business? At CoCreate Financial, we work with business owners at all stages so that your business gives you the most opportunities to live the life you want. Whether you're just starting your business, making plans for strategic growth, or preparing for your next adventure, CoCreate Financial Advisors integrate business planning and advanced exit planning services with comprehensive financial planning and wealth management.

Where are you in your journey?

[et_pb_section fb_built="1" theme_builder_area="post_content" _builder_version="4.18.0" _module_preset="default"][et_pb_row _builder_version="4.18.0" _module_preset="default" theme_builder_area="post_content"][et_pb_column _builder_version="4.18.0" _module_preset="default" type="4_4" theme_builder_area="post_content"][et_pb_text _builder_version="4.18.0" _module_preset="default" theme_builder_area="post_content" hover_enabled="0" sticky_enabled="0"]News about Silicon Valley Bank’s failure has been somewhat of a nerve racking moment for those who remember the Lehman Brothers collapse before the crash in 2008. It’s an especially unnerving moment considering the economic challenges involved in unwinding the covid stimulus passed out over the past several years. We’ll continue to see turbulence for some time from these events in the coming months, but we’ve been well prepared for economic growth to slow under the pressures of inflation since 2020 and for a period rapidly rising interest rates long before that. So when we look at a bank failure in the context of our economy, and more specifically considering the specific businesses our clients own in their portfolios, we need to do so carefully and methodically. While there are a few similarities between the SBV and the Lehman Brothers collapses, the differences are far more striking and SVB’s failure will not do substantive damage to the economy and financial markets on its own.

Bank failures are actually quite common. According to the FDIC, there have been 73 failures in the past 10 years. These can happen for a variety of reasons, but the overwhelming majority are isolated problems that are the result of the failed bank’s business practices. Silicon Valley Bank’s failure is a perfect example of such and isolated, run-of-the-mill failure. Failures from systemic problems, like the Lehman Brothers collapse, are quite rare.

Most people struggle to understand the “bad loans” that caused the 2008 crisis. When congress established Fannie Mae and Freddie Mac to buy packaged loans from banks, they altered the mortgage industry forever. Instead of Banks making loans from their own capital, they had an instant investor—the Government. To stay competitive, banks had to adjust their business models so that they could originate loans and sell them according to Fannie or Freddie’s standards. These standards dramatically lowered standard requirements for a borrower. No longer on the hook for the a long-term, banks began to make loans and move on. This legislative action affected all banks, so it was systemic rather than isolated.

Fannie and Freddie package these loans together to be sold to private investors in investment vehicles called CMOs. Lehman Brothers was heavily invested in these complex investments. The problem was, congress had established a rule that forced the CMOs to be valued in a way that did not reflect the quality of the mortgages in each CMO. Because of these “mark-to-market” accounting requirements, investors had to way to understand the real value (or lack thereof) of what they owned. As a wave of foreclosures began, banks that were significantly tied to these CMOs struggled greatly. Lehman Brothers and others collapsed as a result.

Silicone Valley Bank is a different case. Sure, it’s a larger bank than most that fail and rapidly rising interest rates have affected it to a degree, but real reason for its failure has to do with its own business practices. Most banks diversify their products, loans, investments, and customers across a wide range of businesses and individuals. They also tend to be relatively conservative with their capital investments. SVB focused much of its business on venture capital and small publicly traded companies. These are both very high risk categories that have faced significant struggles post-covid, and SVB did not appropriately staff its risk management department, operating for nearly 8 months without a Chief Risk Officer. These are problems few banks face, and when they are well managed and diversified they will not have problems.

Rising interest rates have affected the banking industry, but we believe that most of the financial sector is quite healthy looking out a year or two. Think of how much more profit a bank can make on an 8% interest loan vs a 3% interest loan. The challenge, in the short term, is that depositors are expecting more interest when the bank’s loan portfolio is still producing at lower rates. For a simplified example, the bank made a loan to a customer last year at 7% at that time, they were paying interest on to customers CDs at 2%. That CD gave them the capital to make the loan, and the bank profited 5%. Now, the bank needs to pay 5% on their CDs to customers, but the loan was locked in at 7%, so the bank’s profit margin is only 2%. Soon, they will make a new loan at 10%, and be able to achieve their previous level of profit, or their variable rate loans will adjust and mitigate some of the impact of rising rates. Banks also have many other ways to generate income. Rising rates have been inevitable for some time now, and we’ve had confidence in banks with diverse revenue sources, substantial variable rate loans, and a strong deposit base.

All that to say, the banking system is in-tact. At the same time, its an important reminder to make sure if you have substantial assets at a particular bank, that you are fully covered by FDIC insurance. They will cover up to $250,000 per account category at each institution. Your accounts we manage at TD Ameritrade or Schwab have spread the cash balance among multiple banks so that you have sufficient coverage for cash. If you’re unsure about your situation, feel free to reach out to us at any time and we can help you evaluate your FDIC Insurance coverage.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]Matt and Rebeka were both discharged from the hospital yesterday afternoon and are recovering well. Matt will have his follow up visit on Wednesday, March 8th and we will be flying home on March 9th!

Matt is recovering well and has mostly been sleeping so far. If you want to send Matt a card you can go to ecards.upmc.com and they will print your card and bring it to him. Here is the information you will need:

Hospital: UPMC Montefiore

Room Number: N1175

Hospital Service/Unit: 11 North

Both Rebeka and Matt are doing great! Rebeka was finally out of surgery at 9:40pm. The new liver started working right away and she is already looking healthier. Thank you everyone for all your prayers and going on this journey with us!

Matt is out of surgery and everything went as planned. He is in recovery now an will be transferred to his room soon. Rebeka's surgery is also progressing as planned and will take about another 5 hours. Thank you everyone for all your prayers and support!