If I owned a Taco Truck (AKA, the perspective of a professional Wealth Manager)

Matt Hudak, AAMS®, CFP®

CoCreate Financial, Founder & CEO

Over the last couple of weeks, we’ve watched Coronavirus stir panic across the United States. This past weekend, OPEC met to negotiate oil pricing for participating countries. When Russia wouldn’t agree to reduce production, Saudi Arabia slashed their prices in retribution (this isn’t atypical OPEC behavior). The American people saw this as even more reason to panic and the stock market continued to drop.

As a professional investment manager and financial planner, I want to tell you a few things I absolutely love about the situation in which we find ourselves this morning.

The Personal Economic Benefit of novel Covid-19

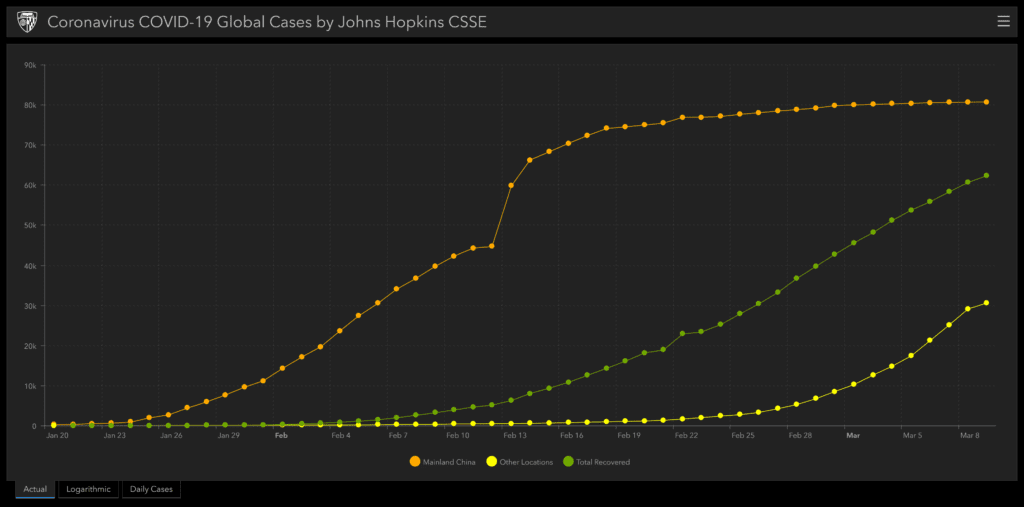

I wrote about the economic implications of CV last week… for those who missed the article, they are extremely minimal. As of this morning the spread of the virus through mainland China has slowed to a near halt and, while the virus is slowly making its way around the globe, the number of recoveries (62.4k) are massively outpacing the number of new cases (30.6k). The end result, the CV outbreak is subsiding. Sure, we’ll have a quarter or two of earnings reductions for a few companies, but we should play catch up throughout the remainder of the year.

| Q1 | Q2 | Q3 | Q4 | 2020 |

| 2.1% | 0.25% | 3.0% | 3.8% | 2.3% |

Projecting the year’s economic growth (by GDP Growth) with coronavirus we will still have GDP growth for the year of about 2.3%. While this is lower than I would hope to see, it is still growing at a reasonable pace.

What Coronavirus did accomplish for our financial system (the part I’m excited about), was create an opportunity to purchase stable sources of income at discounted prices and to strategically generate tax savings. Of course, this only works if you’re making business-minded investments (for stock traders and index fund investors, the recent volatility just hurts).

The Fiscal Stimulus of Cheap Oil

I find it fascinating that OPEC decisions like this one often lead to short-term declines in the stock market. The S&P 500, essentially an average for the 500 largest US companies that are traded on the stock exchanges, dropped in price substantially. What’s fascinating, is that the companies the average represents actually received a boost to their financials.

If I owned a taco truck…

If I owned a taco truck

and parked it down the street,

I’d spend money on beans and beef

and pork and lots of things to eat.

If costs are high, when people buy

themselves a tasty treat,

I’d find that I have less at times

to keep for me and mine.

But when beans go on sale…

I have plenty room for profits to avail

and money to put food on my own table.

If I owned a taco truck

and could drive it down the street

I’d need more supply to feed new customers of mine

and another truck to park on their street.

So I’m no Robert Frost… But I can tell you that if I owned a taco truck, it might cost $2.00 to make my lunch special that I sell for $4.50. At the end of the day, I get to keep $2.50 of profit to support my family. IF beans and meat and cheese go down in price and I can make my lunch special for $1.50, I now have $3.00 in profit. That’s 50¢/taco that I can use however I want. I can pay down debt, pay for my kid’s education, buy a boat, or I can use it to grow my business. This results in more profit for me over time.

Lower oil prices are like discounted beans. Every business has energy costs, so lower oil (or other energy) prices mean more profits. If my taco truck makes more money, its value goes up proportionally. This is true for our stock market. The sudden drop in oil prices actually increase the value of every business in America that is not dependent on the sale of oil for their profit.

The “markets,” however, have never been rational. Instead of looking at a business’ value, people are selling out in mindless panic. SO there are bargains to be had in which you can buy the same dividend cashflows for less than you could a few weeks ago, and if a company’s profit is resilient, then their dividend payouts should be as well.

As I contemplate our situation, I recall a figure from my research a few years ago when oil prices declined: a $0.01 drop in gas price puts around $1 BILLION back into the pockets of the American Consumer. I can’t confirm this number is precise for today, but it gives you an idea of how much we stand to gain from cheap energy. EVEN MORE IMPORTANTLY, the United States became a net-exporter of oil to OPEC nations back in 2015, and we have, in each of the past 5 months, sold more oil to them than they have to us. Because the U.S. is energy independent, we have the freedom to choose how we are affected by a small, focused trade scuffle between Saudi Arabia and Russia.

The recent decline in oil price is good for our portfolios, and the unnecessary panic can help give us a nice discount.

The Industrial Information & Technology Revolution

There are many more reasons to believe that the economy is going to continue to accelerate. We are experiencing the dawn of a new age in manufacturing, data processing, machine learning, data storage, communication (5G), Genetic-based treatments for disease. It’s all coming together at the right time, and the technological revolution, which was in its infancy when we all purchased our first iPhone, is now entering adolescence and we will soon feel its impact more than ever.

| I remember when... | Now... |

| I looked up phone numbers from a book | I use voice control and the internet |

| We typed commands into a computer that took up the whole desk. | I don’t even have to type |

| We had to unplug the fax machine to connect to the internet… | I’m never disconnected and can download at 2 Gbps/second (soon to be 100) on my phone. |

| We managed & stored paper files | AI manages our storage & document security and we can access them around the globe. |

| When work was location based | we work from wherever it is most efficient. |

| I remember learning about the assembly line | Kids are learning to print parts and make robots in school |

| We watched worn out Video-Cassettes we rented from blockbuster. | “What’s Blockbuster?” You can watch anything anywhere as long as you have your phone… in HD. |

Technology has developed to the point that we have complete mobile systems that can produce with extreme efficiency and automation. They reduce costs while increasing output, customization to consumer, and flexibility of service/product delivery. Now that these systems exist, they are beginning to integrate seamlessly with one another. 3 years ago, remote employees were a viable option at select positions in the service sector, particularly for tech-savvy businesses. Now as all of these technologies mature into their adolescence, we are starting to see comprehensive solutions that make normal businesses location agnostic.

The growth we’ve seen in the last ten years is only the beginning. Sure, there will be ups and downs in the market, and we will certainly experience some growing pains. We’re at beginning of one of the greatest opportunities investors will have in our lifetimes.

Be patient with the markets, and take advantage of good opportunities. This is part of how we create a future… together.