If you own rental properties, in the last year and a half you probably have asked the question, “Should I sell?” Maybe it is a thought you have quickly pushed to the side, or maybe you have already unloaded a property or two and are deciding how to best utilize your proceeds. There is a collection of reasons every landlord is asking this question right now and they are important to examine. But even if you decide you should sell a property, the next question is if you can do something else with your proceeds to replace the steady income you received form your rental. In this article we are going to examine the reasons why you should carefully evaluate your real estate holdings at this moment, the considerations you should include in your evaluation specific to your property and situation and finally how you can structure investments to replace, and maybe even improve, the income you received off your real estate.

Real Estate Rental Risk – Welcome back to the Wild West

It is no secret that many investors have been off-loading their rental real estate holdings, especially residential rentals. There are some obvious reasons as to why this is the case, and there are some additional reasons that are less popular to discuss. Let’s start with the obvious. The shut down orders precipitated by COVID caused people to value “home” more and sent many people looking for larger spaces and the prices of homes skyrocketed. There are some additional reasons for the dramatic increase in home prices, but we are not going to get into all of those here. Suffice it to say that we have had a national housing shortage for many years and the US Government’s response to COVID created a perfect storm. It really doesn’t matter where you are in the country, home prices had a significant jump (even Detroit is up more than 18%)[1]. As a landlord, it is natural to ask, “If the market is high, is it a good time to sell?”

In the investment world we are always talking about risk vs. return. Now, the relationship between risk and return is not as clear cut and consistent as many would have you believe; however, it is only logical that if you have a higher risk, you should demand a higher return to compensate you for the additional risk. In March of 2020 the US shut down, and as all landlords are aware, one of the emergency orders put in place was the eviction memorandum which prohibited landlords from evicting tenants for non-payment of rent if their inability to pay was related to COVID. In its initial form, the eviction memorandum was intended to be short term, but it extended over a year and a half.

There are many types of risk, one of them is regulatory or governmental risk and this is a prime example. Our government changed the rules and in doing so changed the risk of owning residential real estate rentals. We have now entered a reality in which if you have a renter who stops paying rent you may not have any recourse for a significant period of time depending on what is going on in the world. If these moratoriums become precedent, these government sponsored rent droughts might occur on a more frequent basis than we would like to envision. Technically, under the recent eviction moratoriums the tenant will still owe all of their back rent, but if they stop paying for a year, we all know it is unlikely you will ever see that money. An investor has two reasonable options when risk is suddenly elevated – they can demand more return, or they can sell the investment. We have seen this take place very clearly as landlords have responded by raising rents and/or selling their rental holdings.

While some owners of residential real estate are large apartment complex companies, many are individuals that own a handful of properties, or maybe even only one or two. For the companies that have many units, the risk, while still elevated, can be dispersed among their many holdings. This is more difficult for the investor with only a few properties. In this case, a tenant who stops paying may have a significant impact on your ability to pay your own bills and it is difficult to raise the rent to a level that would mitigate or appropriately compensate you for this risk. While often effective, real estate rentals are frequently not diversified—a concentrated risk for a property owner. It can be highly effective when things are going well, but unmitigated catastrophe when things turn sour. I want to pause here for a bit of a sidebar. This elevated risk of residential real estate rentals highlights the significance of having appropriate cash reserves. If you determine the best choice is for you to maintain some or all of your rental properties, it is critical that you maintain appropriate cash reserves. The determination of the right amount of cash reserves is specific to your situation and your various income sources, but I would at least start with asking “could I still pay all my bills if I had no rental income for a year?”

A Steady Income Stream

Rental properties are attractive to many investors because of their ability to provide a steady income stream. Many people utilize a strategy of acquiring a rental property during the wealth accumulation phase of their life through conventional home financing, using the rents to pay the mortgage on the property so that it is paid off around the time of their retirement at which point they can take almost all of the rents as income. Whether or not you have started using your rental income for your living expenses, the goal is to create steady income at some point in time. The good news is that there are multiple ways to create steady income streams that are diversified and give you far more flexibility than a rental property.

At CoCreate Financial we craft portfolios owning high quality, stable businesses that are committed to paying their owners a portion of their profit in regular increments. This functions a lot like a good real estate investment. As an owner you receive both compensation for your ownership through these dividend payments (similar to rents), as well as appreciation of the value of your shares as the company continues to grow and increases their dividend payments over time. This method provides a steady income stream as well as greater flexibility in your finances than owning real estate.

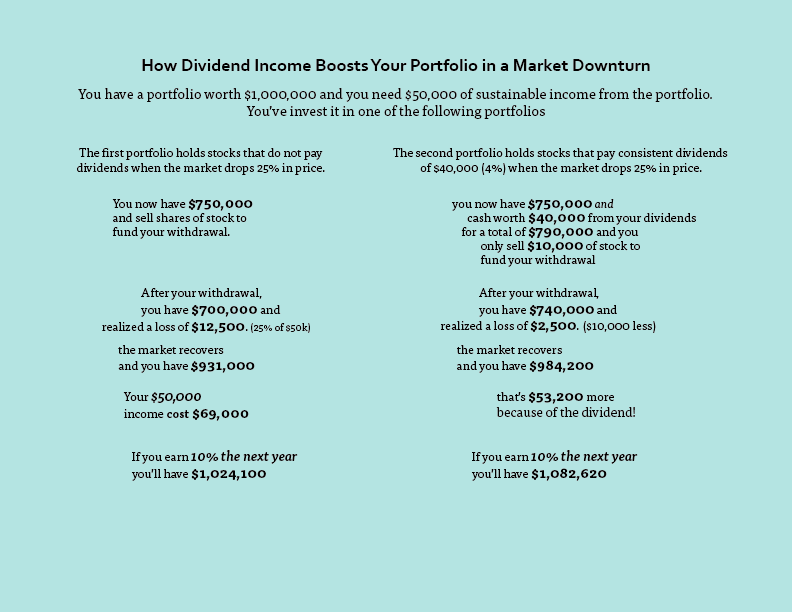

Let’s start with examining the income stream in a bit more detail. Dividend payments on equity investments are generally expressed as a percentage of the current value of the share of stock, however, they are actually a set dollar amount established by the Board of Directors of the corporation and are generally paid out quarterly or semi-annually. The Board of Directors will typically evaluate the dividend on an annual basis, so it does not change with fluctuations in the market. We look for companies who have a long history of regularly increasing their dividend and have the available cash flow to continue doing so. This means that dividend payments continue to come into your investment account (or personal checking account if you so choose), even when the market is in a slump, providing stability to your cash flows.[2] Investments selected for their financial strength and dividend-paying consistency typically do not decrease their dividends in turbulent times (they often increase their payout). The other advantage of a diversified dividend-paying portfolio is that it provides a rising stream of income which is more resistant to inflation than most other methods of generating investment income and does not require you to actively increase a tenant’s rent.

But, as in real estate, we want to see a portfolio that appreciates as well as produces income. The good news is that this is also a benefit of high-quality dividend-paying stocks. And, to make things even better, the growth of each stock’s value in your portfolio is based, in large -part, on the present value of real cash flow and not solely on speculation about its future sale price. When you buy a company that pays a dividend, you are buying an income stream. As the company continues to raise their dividend over time, the value of the income stream rises which drives the value of the underlying security.

Don’t Forget About the Tax Man

Okay, let’s say you are concerned about the newly amplified risks in residential real estate and/or you are attracted to the prices you are seeing similar properties around town. Before you give your tenants notice and throw up a for-sale sign, you want to make sure you have made a full analysis of your situation.

The current long-term capital gains tax rate tops out at 20% and this will likely increase in the very near future based on legislation proposed by democrats in Congress. However, there is generally another component of rental real estate taxes which is depreciation recapture. You will recall that owning real estate has been great for your taxes. This is because the IRS allows you to deduct depreciation, which is supposed to account for an asset being used up or worn out. This is a little different for real estate than a business vehicle because real estate typically appreciates in value. Essentially, when you sell the property, if it has appreciated in value the IRS wants to recover those previous tax breaks from you.

The calculation for depreciation recapture is a bit complicated and very specific to your situation, so we are not going to get into the details of it in this article. If you are considering selling a rental property, it is very important you discuss the tax implications with your CPA so you have a clear understanding of how much is going to be shaved off your proceeds for taxes. You may also be able to mitigate some of your taxes through retirement plan contributions and such, but to maximize your options you will want to be sure you are planning well in advance.

In addition to being aware of the tax implications, do not forget to also account for the cost of selling your property. Typically, sellers pay the closing costs of real estate transaction at 6% of the sale price.

When you compare your other investment opportunities it is important that you use your estimated net proceeds from your real estate sale, not the market value of the property. Your net proceeds are what you have left after sale costs, taxes and paying off any loans against the property.

Replacing Rental Income with other Income Streams in the New Reality

The unfortunate reality is that while real estate investments have been one effective workhorse wealth building and income strategy for a long time, the amplified risks demand careful evaluation by every investor. There will certainly continue to be opportunities in real estate, but these should be considered in the context of the newly established precedent in the current regulatory environment. Especially for individual investors who rely on the income from their real estate investments, a strategically managed, dividend focused portfolio may prove to be a more flexible, diversified and efficient investment. If you are starting to consider transitioning out of a real estate investment, or are in the process of finding a replacement income stream from the recent sale of property, schedule a call with one of us to start exploring your options.

[1] Source: Case-Schiller MI-Detroit Home Price Index as of 10/12/2021.

[2] Disclosure: while many companies have routinely increased dividend payments for decades, Dividend payments are determined by the board of directors, are subject to the financial condition of the issuing company and cannot be guaranteed.